Liability Insurance

Aircraft Liability Insurance: Market Leading Coverage in Minutes

Rate-saving excellence from the worlds top aviation insurers.

Get access to independent advice

Get exactly the right cover for your needs

Speak directly to an aviation expert

Specialists in worldwide risk

What is Aircraft Liability Insurance?

Typically covers bodily injuries to passengers and or third parties, and property damage to third parties.

Policy covers damage to all types of aircraft, including jets.

Aircraft housed within an airfield hangar or airfield premises

It is additional insurance that protects the property owner or occupier, providing a very important buffer for their own insurance policies.

Hangarkeepers caters for any third-party aviation equipment whilst it’s in the custody or control of the insured. It doesn’t need to be inside a hangar

Insurance feature 1

This is the most fundamental insurance to cover yourself against damage against control that you don’t own, but have in your hangar or on your premises.

Insurance feature 2

The critical facts are that Hangar Keeper Insurance protects you and your business, against any damage to aircrafts or parts that belong to someone else.

Insurance feature 3

Following implementation, we’ll undertake a rigorous UAT process

Insurance feature 4

Once live you’ll earn 7.5% on every insurance transaction sold

WHO CAN BENEFIT

So who is a Aircraft Liability Insurance for?

Owners and/or Occupiers of premises that warehouse aircrafts and goods

Any repair, maintenance and service provider

Ground handlers

Any commercial aviation premises

Owners of airfields

Aircraft product manufacturers

Logistics Services

This is a section heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed vitae justo et ante condimentum fringilla vel eget risus. Integer hendrerit sapien condimentum mi ultricies feugiat. Morbi fringilla lobortis cursus. Quisque enim dui, malesuada a elit ut, dapibus ultricies dui. Curabitur sapien ligula, volutpat in felis et, tempor finibus ligula. Vivamus pretium risus in est efficitur ornare. Donec aliquet augue erat, ac dictum tortor sollicitudin a.

This is a sub title

Calculate Affordability

Discuss your Goals

Provide Impartial Advice

Access your Requirements

Frequently Asked Questions about Liability Insurance

I already have liability insurance. Why do I need this?

That’s excellent. But how do you know you’re getting the best value? We have had instances where clients are insured through general insurers and policy wording excludes aviation components or practises. So, it costs you nothing for an independent expert to review your policy and requirements and give provide a current review. If you already have the best deal, then they will advise you to stay with it. But usually by shopping around at renewal you will get a better deal or the ability to bundle policies to enjoy a better dela overall.

How long does it take to get a quote?

Flycovr guarantees to connect you to an aviation expert in 60 minutes or less. This is the first phase of understanding what exactly you need and connecting you with the right regulated insurance partner to provide the advice that you need. All of this can be done within minutes. Typically, our clients are talking with an insurance partner within the hour or at least the same day in most cases. There are not many policies or provisions our team has not come across as we work with some of the most trusted and reputable insurance brokers and underwriters on the planet. Together, we will expedite the process minimise administration and get you a quote within hours.

I already have this as part of a larger policy. How difficult is it to switch over?

It’s simple. We do this all the time. Our trusted insurance partners. Having reviewed your specific. Requirements will usually request oversight of all your other insurance requirements. So that they can take everything into consideration when providing you the best liability quote. Often great deals can be found by bundling policies. And it’s very straightforward to switch over one or all your policies to our partners. We will see. We will support you throughout the whole process to ensure a seamless switch.

Frequently Asked Questions about flycovr Ltd

Does flycovr advise on insurances?

No, flycovr Ltd, is an independent platform that is not regulated to advise on insurance by the Financial Conduct Authority. Flycovr acts as an introducer and connects customers with regulated advisers specific to your needs.

What does being “an introducer” mean and are flycovr Ltd regulated by the Financial Conduct Authority?

flycovr Ltd can obtain customer information and provide access to insurance products if the information is deemed suitable for that area of specialism for that regulated insurance adviser.

Under Chapter 5, of The Perimeter Guidance manual, within the FCA Handbook, flycovr Ltd operates as an introducer or referrer, enabling the provision of information about a potential policyholder to a relevant insurer or an insurance intermediary. Our regulated and specialist broker partners will organise and underwrite all insurance policies. Flycovr Ltd does not provide or underwrite the insurance products purchased.

Who has access to my data?

flycovr Ltd will have to provide the information provided by our customers to insurance advisers to be able to get you the correct advice required for the desired insurance products. flycovr Ltd will not pass your information onto any other entities other than registered insurance providers within the flycovr network.

Talk to an Aviation Expert within 60 mins

Access Global A-rated Products

No fuss, no obligation quotes

Global support

ABOUT

Leveraging cutting-edge technology and unparalleled industry expertise, Flycovr transforms air freight insurance, delivering specialised coverage in 40 seconds or less.

Creating a more sustainable supply chain by redefining how insurance is bought and sold in our industry.

Calculate Affordability

Calculate Affordability

Calculate Affordability

Aircraft Liability

Thypically covers bodily injuries to passengers and/or third parties, and property damage to third parties.

Coverage

Most policies of this nature are arranged on an agreed value basis by the underwriters, in which a fixed value is placed on the aircraft at the begining of the policy. However, you designated specialist can advise on this.

Our specialists advisers can discuss the process, and you may come across some of the following that maybe considered in your protection requirements:

- Ground risk coverage

- Non-owned hangars and content coverage

- Trip interruption expense coverage

- Geographic limits

- Premises medical coverage

- Spare engines and parts coverage

- War risk coverage

Your Considerations

- Value of policy required

- Use of the aircraft

- Experience of pilot, training, history etc

Talk to an Aviation Insurance Expert Now!

Vivamus ut malesuada erat, at imperdiet ipsum. Donec lacinia nunc finibus nunc posuere mattis. Nam lobortis ipsum non odio elementum, et dictum turpis gravida. Vivamus venenatis mi ut tempor elementum. Aenean aliquet nunc tortor, at posuere enim molestie eget. Vivamus nec finibus libero. Ut rhoncus dolor a dolor commodo molestie. Praesent in arcu id ipsum tristique laoreet. Nam tincidunt turpis sit amet auctor convallis. Maecenas sit amet felis non mauris ultricies porta. Vestibulum rhoncus ultrices nibh ac varius.

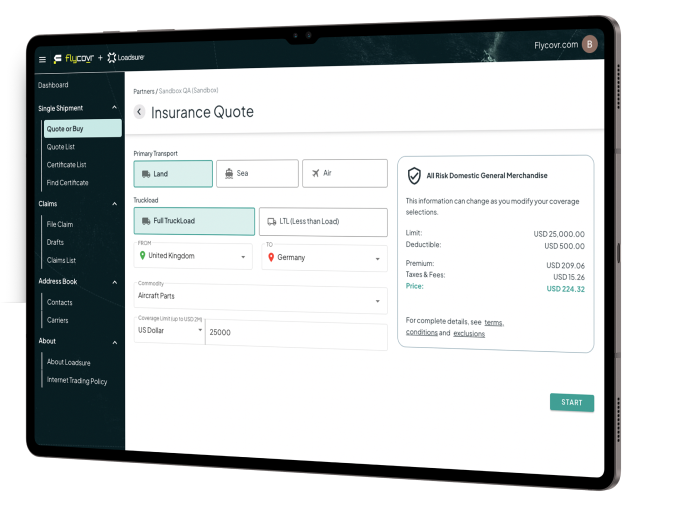

All-risk shipment coverage quotes in seconds.

All-Risk Global Cargo Cover

A-rated insurance solutions meticulously crafted by aviation experts exclusively for the aviation industry.

A-Rated all risk quotes in 60 seconds

Pay-as-you-go coverage – Only pay for exactly what you need.

Protect stock and freight over land, air or sea

Full invoice settlement in 72 hours or less

01243 200 237

01243 200 237