Freight Cover

Freight Forwarders Insurance: Zero Hassle Multi-Shipment.

Rate-saving excellence from the worlds top aviation insurers.

Get access to independent advice

Get exactly the right cover

Get exactly the right cover

Speak directly to an aviation specialist

What is Freight Forwarders Insurance?

Hangar Keepers Insurance protects you, against damage to a third party’s aircraft whilst it is in your care, custody or control.

Policy covers damage to all types of aircraft, including jets.

Aircraft housed within an airfield hangar or airfield premises

It is additional insurance that protects the property owner or occupier, providing a very important buffer for their own insurance policies.

Hangarkeepers caters for any third-party aviation equipment whilst it’s in the custody or control of the insured. It doesn’t need to be inside a hangar

Insurance feature 1

This is the most fundamental insurance to cover yourself against damage against control that you don’t own, but have in your hangar or on your premises.

Insurance feature 2

The critical facts are that Hangar Keeper Insurance protects you and your business, against any damage to aircrafts or parts that belong to someone else.

Insurance feature 3

Following implementation, we’ll undertake a rigorous UAT process

Insurance feature 4

Once live you’ll earn 7.5% on every insurance transaction sold

WHO CAN BENEFIT

So who is a freight forwarders insurance policy for?

Owners and/or Occupiers of premises that warehouse aircrafts and goods

Any repair, maintenance and service provider

Ground handlers

Any commercial aviation premises

Owners of airfields

Aircraft product manufacturers

Logistics Services

Smart Cargo Insurance

Give your customers instant peace of mind and get back to the business at hand. Create a new revenue stream and help your shippers manager their risk when you upsell all-risk insurance per shipment with smart value added coverage offering automated claims.

All-Risk?

Powered by AI and automation, we provide access to door-to-door coverage, including general average, mechanical breakdowns, inside theft, fruadulant pick-up, loading and unloading damage and Acts of God.

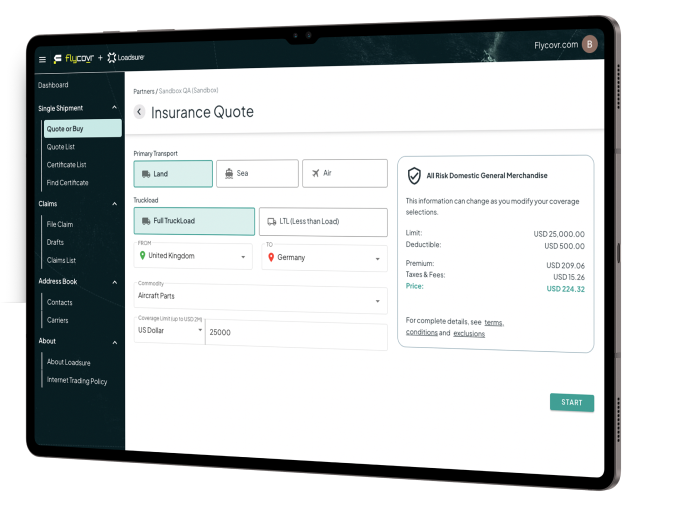

If you need multi-shipment cover over a set period, then we can help you streamline your insurance with just one policy thanks to our partners at Loadsure.

Frequently Asked Questions about Freight Forwarders Insurance

What is Freight Forwarders Insurance?

Product Liability covers the costs of claims from individuals who are injured as a result of a faulty product or from a direct consequence of your business maintenance work, services, designs, manufacturers or supplies.

Hangar Keepers is a claim for damage against physical property such as aircrafts, parts or equipment.

Why do I need Freight Forwarders Insurance?

PPH stands for Premises, Products and Hangar Keepers Liability. These are the three insurance areas that often overlap. Flycovr combine aviation expertise an aviation insurance specialists to ensure you get the right insurance product.

These three insurance products are often bought in combination together to ensure you are fully protected. The acronym PPH therefore ties these together, but you can by Hangar Keepers individually as well as with one or all combined.

How do I buy Freight Forwarders Insurance?

Premises Liability covers claims from members of the public, customers, partners or clients that suffer an injury as a result of an accident or incident that has taken place on your premises. This therefore protects you against claims from any third party against you for something that occurs on your premises where you have been found liable. Hangar Keepers is designed to protect you and your business for incorrect actions taken on another person’s or business’ aircraft or aircraft parts whilst in your care.

Therefore Hangar Keeper’s protects against any damage to the aircrafts, whereas as premises protects you against claims from people that are hurt or injured on the premises. This applies to any property whether a hangar, office or any other commercial storage or maintenance facility.

Frequently Asked Questions About Flycovr

Does flycovr advise on insurances?

No, flycovr Ltd, is an independent platform that is not regulated to advise on insurance by the Financial Conduct Authority. Flycovr acts as an introducer and connects customers with regulated advisers specific to your needs.

What does being “an introducer” mean and are flycovr Ltd regulated by the Financial Conduct Authority?

flycovr Ltd can obtain customer information and provide access to insurance products if the information is deemed suitable for that area of specialism for that regulated insurance adviser.

Under Chapter 5, of The Perimeter Guidance manual, within the FCA Handbook, flycovr Ltd operates as an introducer or referrer, enabling the provision of information about a potential policyholder to a relevant insurer or an insurance intermediary. Our regulated and specialist broker partners will organise and underwrite all insurance policies. Flycovr Ltd does not provide or underwrite the insurance products purchased.

Who has access to my data?

flycovr Ltd will have to provide the information provided by our customers to insurance advisers to be able to get you the correct advice required for the desired insurance products. flycovr Ltd will not pass your information onto any other entities other than registered insurance providers within the flycovr network.

Talk to an Aviation Expert within 60 mins

Access Global A-rated Products

No fuss, no obligation quotes

Global Support

Could You Partner with Flycovr?

Leveraging cutting-edge technology & unparalleled industry expertise, flycovr transforms aviation insurance, delivering specialised coverage in less than 60 seconds.

Creating a more sustainable supply chain by redefining how insurance is bought and sold in our industry.

Flycovr aviation liability insurance

Partner with us – intergrate Flycovr into your platform

Aviation logistics freight insurance – Instant one-off insurance

Flycovr Freight

What Is It?

- A-rated, all-risk coverage for aircraft parts in transit.

- Up to $2m in international and domestic conveyance limits via the digital system.

- Specialty shipments of high-value goods up to $5M, subject to underwriting review, pricing, & terms.

- Referrals for high-value shipments can be expedited when advance copies of carrier contracts, high-value protocols, and standard operating procedures are on file with underwriting.

Risk Appetite

We can arrange cover for any multiple parts and shipments across all commodities:

- Preferred commodities and aircraft parts include containerized cargoes, manufactured products and equipment.

- Coverage for select hard-to-place risks available on demand.

- Risks typically outside the Loadsure appetite include inventory and storage, cash & financial instruments, and luxury goods.

Key Benefits

- Assureds can bind shipments and pay premiums directly from broker-generated quotes.

- More accurately prices risk for competitive, sustainable premiums.

- Automatically adjusts premiums and delivers real savings back to assureds.

Do I need Multi-shipment Cargo Coverage?

The next evolution of Shippers interest insurance is here thanks to a powerful AI-driven digital approach to a proven insurance product. Eliminating former hurdles of set limits, fixed commodity rates and laborious information gathering which have driven up shippers’ interest premiums for years.

With flycovr, you can now access AI-powered shipper’s interest insurance, empowering freight, and logistics businesses to instantly and cost-effectively protect every shipment – all with the predictability of a fixed rating model.

60% of shipments in the USA alone are underinsured

Mainly due to a lack of fast-paced insurance solutions matched to the speed and complexity of the freight industry and global commercial aviation supply chain.

If you are regularly supporting activities such as aircraft part out, inter warehouse or company stock transits or simply trying to facilitate multiple shipments in a set time then flycovr can get you the protection you need effortlessly with Shipper’s interest policy from Loadsure.

Our vision is a more sustainable supply chain for all through access to first-class products and better information that provides “First Party Position” protection from trusted partners when you need it.

Logistics Insurance from the Aviation Experts

Rate-saving excellence from the worlds top aviation insurers.

All-risk shipment coverage quotes in seconds.

All-Risk Global Cargo Cover

A-rated insurance solutions meticulously crafted by aviation experts exclusively for the aviation industry.

A-Rated all risk quotes in 60 seconds

Pay-as-you-go coverage – Only pay for exactly what you need.

Protect stock and freight over land, air or sea

Full invoice settlement in 72 hours or less

01243 200 237

01243 200 237